3 Year Loans Reviews – Get a Long Term Loan

Quick Review

Description: Business, Finance, Payday Loans

What We Liked:

5 Minute Application & Quick Funding , Flexible Repayment Options , Unsecured personal loans up to $10,000 , A good way to buy expensive items , Lower interest rates , Best way to minimize awkward borrowing , Best way to build creditWhat We Disliked:

not available in some states.we hope this 3 year loans review was helpful and answered all of your questions. Three year loan advances are quickly replacing the traditional way of lending and borrowing money. Many people are busy and they don’t have the time to visit a bank to borrow money. Furthermore, no one can accept the red-tape associated with banks today bearing the current state of technology. With the affordable 3 year loan rates that are approved instantly, Americans can have a sigh of relieve because they can get cash advances right at the comfort of their living rooms. There are lots of positive 3 year loans reviews on the internet today and this is an indication that 3yearloans.com is there to help. It is a go-to platform for those who want cash sent straight to their bank account within a few minutes. If you are looking for a long term loan Try it today.

3 Year Loans Reviews – Get a Long Term Loan

ooking for a complete 3 year loans review? Then, you have come to the right place. “3 year loans” is a company that brings lenders and borrowers together to provide a great opportunity for accessing loans. In simple words, the website is there to showcase what different lenders are offering so that you make a sound decision when accessing credit facilities. For many years, the website has helped lenders to get better and affordable loans from the most reputable lenders. Their database compromises only the best firms in the market because the company aims for better loan terms, interest rates, flexible repayment schedules and charges. Because your day may not go as planned, the allocated budget may not suffice and the need for extra and fast cash shows up. But looking for a loans is not an easy task ; there are some criteria that you may check before accepting the contract.

You may think of 3 year Loans Company as a broker. Because, they work with hundreds of website, they are able to provide different loan products for every borrower irrespective of their level of income and credit score. You can borrow as high as $10,000 via the website and repay back within 36 months. The loans usually work well when used for long term investments. For instance, if you need a car but your monthly income does not allow, then, these loans can help you to buy it and repay in a flexible manner. You may also get a loan to pay for your education or even finance a house. Actually, lenders are parties that are ready to lend you money under certain conditions. Prior to that, there are some factors that may guide you through the loan quest. 3 year loans company -as loan matching provider- gives its customers advices to look better for the suitable loans and lenders

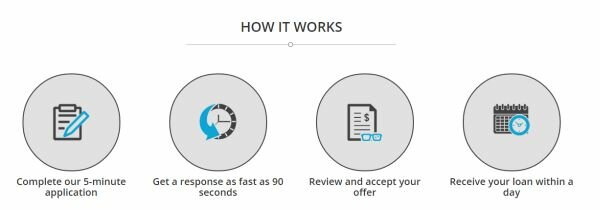

I noticed why many people use the platform to apply for loans when writing this 3 year loans review. First, the loan application procedure is very straightforward. There is no paperwork because the entire procedure takes place on the internet. As a borrower, you must access the 3 year loan website and submit a 3 minute form. The pre-approval rate takes less than 90 seconds. From there, you get the list of lenders that match your profile. You will then have the liberty to choose the best lender, agree to their terms and conditions and get instant approval. The loan amount is finally disbursed to your bank account within a few minutes.

3 year loans general policies :

3 year loans company presents itself as a matching service provider. It links customers in search for loans -especially long term loans– with lenders ready to lend money with the best repayment conditions. It is important to to say that the 3 year loans company specializes in matching clients with long term loans providers ; the company name is already a good indicator of the main activity of the company. The company advises customers to pay attention when discussing terms of the loans’ contract with lenders. The company reminds customers to borrow responsibly ; the long repayment period and the comfortable repayment conditions are not to completely relay on.

3 year loans

Borrowers like 3 year loan because they are more manageable than instant loans. Since the repayment term spans over a period of 36 months, people with low income can choose lower repayment installments that they can afford. If well planned such loans help customers to get out of the poverty level. The loans can also be used to consolidate debts. For instance, if you have more than one loan from different lenders and are you are unable to repay, you can secure a single 36 months loan and repay the debtors. From there, you can continue submitting only a single monthly repayment to the 3 year Loans lenders.

Borrowers like 3 year loan because they are more manageable than instant loans. Since the repayment term spans over a period of 36 months, people with low income can choose lower repayment installments that they can afford. If well planned such loans help customers to get out of the poverty level. The loans can also be used to consolidate debts. For instance, if you have more than one loan from different lenders and are you are unable to repay, you can secure a single 36 months loan and repay the debtors. From there, you can continue submitting only a single monthly repayment to the 3 year Loans lenders.

The three year loan website simply works as an aggregator and the terms of the loans are different from each lender. However, the basic application procedure is same. For instance, majority of the financial institutions require you to submit your Social Security Number, level of income, contact details of your business or employer as well as valid address information. Your bank information is also a necessity to aid the loan disbursal. However, each lender can have different rates and charges. The only way to calculate the true cost of the loan is to find the loan’s APR (Annual Percentage Rate). You must liaise with your lender to find this figure to aid you to make a better decision.

Unlike traditional loans, 3 year loans are signed electronically, you don’t have to visit your lender physically. This helps in saving time while still eliminating the lengthy process associated with outdated lending procedures in the banks. The loans are very instant and they have helped many people especially those who are in dire need of money but are strapped for cash. In fact, the loans are the excellent way to go for many US residents who are struggling with finances but can not access loans from the banks. It is fun applying and getting approval for loans that can be repaid for a period of 3 years – everyone can manage this and furthermore, majority of borrowers have repaid their loans even before the period elapses meaning there are no risks associated with this kind of lending.

What to take in consideration when looking for a loan?

3 year loans reviews describes the factors you should take into consideration when looking for a loan; these factors can be listed as follow:

Ø Lending policy : Lenders have different lending policies ; some may ask for charges and fees to complete deals ; others may ask for additional papers to furnish in order to ensure the eligibility of the client. Generally, the loan matching provider that you use warns you about these extra conditions. 3 year loans include this message and it reminds that the company is not a lenders and that customers will have to discuss further terms with each lender.

Ø Repayment terms : the repayment period, APR and penalties are the most important factors to know before completing deals. In fact, 3 year loans company warns customers of the importance of the repayment period and its influence on the APR -consequently on the interest rate- and on the penalties in case of repayment inability.

Ø Eligibility: It is important to check your eligibility by your own before applying. Because of some restrictive laws, you may not be eligible due to your loan’s purposes, credit history, or juridical state or social state. Already, some loan matching providers like 3 year loans are not available all over the countries where they are based; credit history is not a handicap for some lenders whereas it is a major constraint for others.

Review

3 year loans reviews

I have read many 3 year loans reviews just before writing this article. However I have not found a single negative 3 year loans review on the internet. Majority of borrowers have posted positive testimonials. They understand that the loans are the way to go if one uses them for the right purpose. As a borrower, you must not deviate from the purpose of the loan once the cash is released to you. You must also borrow wisely to stay on the track. Only borrow if you really need the money. Remember, a 3 year loan requires a commitment of 36 months. Getting a loan is certainly a move that you should take with extreme care

I have read many 3 year loans reviews just before writing this article. However I have not found a single negative 3 year loans review on the internet. Majority of borrowers have posted positive testimonials. They understand that the loans are the way to go if one uses them for the right purpose. As a borrower, you must not deviate from the purpose of the loan once the cash is released to you. You must also borrow wisely to stay on the track. Only borrow if you really need the money. Remember, a 3 year loan requires a commitment of 36 months. Getting a loan is certainly a move that you should take with extreme care

Another positive thing about 3yearloans.com is their customer support. Apart from their real-time representatives, they have an updated FAQ section that answers almost all questions that borrowers have on the loan products. Also, the 3 year loans company has done its best to advice borrowers on how to borrow and spend money wisely. Most amazingly, the website has an innovative payment calculator that takes the amount borrowed, credit score and installments schedule in to account. In case a borrower is stuck, the website responds to emails within a few minutes.

The 3 year loan website is the best loan matching service Company that has put innovation in to practice while caring for customers of all classes. With their thousands lenders, the website has allowed many people to get their desired loan and adjust their budgets without straining to pay the loans. The faster loan application procedure due to automated algorithm has made the website as the number one people’s choice and a go-to platform for applying for loans. Whether it is a long term or a short term loan, the loan terms are to discuss in depth before completing the process

The website saves a lot of time to borrowers because they would have manually compared the lenders to find a reliable loan product. Don’t worry again when you are stuck by a financial problem, let the website handle the hard work for you and anticipate a better tomorrow. You don’t have to physically visit different lenders to learn about their loan products, interest rates and charges. With the website, you simply enter your profile details and the entire procedure runs in background to match the best lenders with affordable loans that have the highest loan amount.

Is three year loan legit?

I have seen questions like, “Is three year loan legit?” The answer is a good “Yes”. The website is licensed to conduct their loan matching business to offer big loans with more time to pay. They have installed an SSL certificate and their website URL starts with “https” instead of “http”. This is one indication that the website is serious about their customers’ private information. The 3 year loan has a great privacy policy; they will never sell, lend or share your information with third party members because they don’t want your inbox to be flooded with promotional emails.

I have seen questions like, “Is three year loan legit?” The answer is a good “Yes”. The website is licensed to conduct their loan matching business to offer big loans with more time to pay. They have installed an SSL certificate and their website URL starts with “https” instead of “http”. This is one indication that the website is serious about their customers’ private information. The 3 year loan has a great privacy policy; they will never sell, lend or share your information with third party members because they don’t want your inbox to be flooded with promotional emails.

The flexible repayment options and unsecured loans also make the website a good resource for applying for loans. The website loads quickly and the company does not require you to enter credit card information apart from the bank account where your loan is disbursed. The site is totally legit because it has loans with APR as low as 4.99%. The entire process of loan application takes less than 5 minutes – thanks to their quick funding option and innovative algorithms that do loan matching in real-time.

3YearLoans.com is the only personal loans search engine that brings accurate results. You don’t have to engage endless battles with banks while accessing loans because the website has really created a platform that eases the procedure of loan application. Furthermore, the site is free to access and this makes the procedure a pain-free undertaking. The website is recommended to all people who need money and more time to repay because the monthly payments are very low even for those who earn little cash each month. it is important that you know exactly what are you going to do with it and how much you need to be in wealthy state and to build a reliable credit history.

While writing this 3 year loans review, I noticed that majority of people who have posted testimonials about the website had a hard time when applying for loans before and their approval rate was below averaged. However, their lives have become easier after registering at the 3yearloans.com website. You don’t have to go through a rough time when finding a personal loan. The company understands that life is very challenging especially if one does not have money to spend. They therefore advise borrowers to look at their largest network of personal loan lenders. You just need to complete the application and get an obligation-free quote within a few seconds. The 3 year loans company ranks among the best matching service providers. It offers a very important database of lenders who are able to grant loans repayable on long term basis with very affordable conditions.

The website only works with trusted lenders with proven track record. They have also made sure that every lender can advance higher loan amount to people. The company has helped many people to make sudden purchases even with their tight budget. There are thousands of happy customers who thank the company each day because they were able to upgrade their homes, cater for medical expenses or even conduct an expensive wedding. So, the 36 months loans are what you need to pay for your past, present and the future without worrying about your financial problems. Amazingly, the funds are approved instantly and you can smile all the way to the bank to collect your money – quite easy and fast. So, stop asking “Is three year loan legit? “ Just take action today. 3 Year Loans reviews shows that it has a simple and easy application process followed by a very fast approval.

What are 3 year loans?

3 year loans are cash advances that can be repaid for a period of up to 36 months. The loans are extremely secure and very fast to apply by accessing the 3yearloans.com website. The loans follow 2-step verification. First, the borrower submits basic information on the website. The algorithms then perform a quick search to determine the authenticity of the data entered. Finally, the search engine compares the lenders profile with the most relevant lenders in the country and sends out a quote to the borrower’s email.

3 year loans are cash advances that can be repaid for a period of up to 36 months. The loans are extremely secure and very fast to apply by accessing the 3yearloans.com website. The loans follow 2-step verification. First, the borrower submits basic information on the website. The algorithms then perform a quick search to determine the authenticity of the data entered. Finally, the search engine compares the lenders profile with the most relevant lenders in the country and sends out a quote to the borrower’s email.

Before you decide to apply for loans using the 3 year loans company platform, it is recommended that you read the many 3 year loans reviews -including the present one- you may come across when browsing for information about this aggregator.

Next, the borrower will choose the preferred lender depending on the quote sent on the email. He/she will then accept the terms and condition set out by the lender including the interest rates, charges and installment schedule. An electronic signature is also required before the approval. Once the borrower consents on the loan, lender will automatically disburse the amount to the bank account. The procedure is so fast and easy even for those people who don’t know how to use the computer well. An internet ready device is all that is required.

The entire process is safe and secure because the information is protected by a 256-bit VeriSign SSL encryption technology. So, you should not worry about your classified information because every piece of data is completely protected from hackers and malware attacks. The quick approval is not confusing because there is no endless paperwork even when it comes to finalizing the loan agreement.

The automated procedure ensures that you get the best loans depending on your profile. 3 year loans offers a good experience for those who want a quick, easy and a stress-free way to access long-term loans. Today, it could be very hard to get a long-term loan and approval in the same day without the platform. Therefore, the loans have helped many people to access funds faster within the same business day. Also, there are no fixed obligations until you decide to accept your loan terms and associated fees. You may reject a quote from a specific lender if the loan conditions are not favorable to your needs.

3 year loans requirements

There are some basic requirements that lenders look for before advancing the cash to you. This may vary from one lender to the other but I am going to list the basic 3 year loans requirements for you in this 3 year loans review:

Fair or Better Credit

In United States, the credit worthiness of a customer is based on a credit score. This is just a simple figure that indicates the risk that lenders have if they advance cash to you. Borrowers with higher credit score are considered as safe borrowers because they have a higher likelihood of repaying their debts. The score is between 300 and 850. Customers’ credit score are reported by financial institutions that issue loans to people. You can improve the figure by repaying the loans on time. Also, you will have no score if you have never acquired a loan from another institution.

In United States, the credit worthiness of a customer is based on a credit score. This is just a simple figure that indicates the risk that lenders have if they advance cash to you. Borrowers with higher credit score are considered as safe borrowers because they have a higher likelihood of repaying their debts. The score is between 300 and 850. Customers’ credit score are reported by financial institutions that issue loans to people. You can improve the figure by repaying the loans on time. Also, you will have no score if you have never acquired a loan from another institution.

To simplify how borrowers understand the credit score, the 3yearloans.com has put the figures in to groups:

- No credit – No score

- Very bad credit -549 and under

- Bad credit -550-649

- Fair Credit – 650-699

- Good Credit – 700-749

- Excellent Credit – 750+

You can check your credit score on credit bureau websites like Equifax to know where you stand and see whether you can qualify for the 36 months loan.

Income of $2,000 Monthly

3 year loans requirements also require borrowers to have an income level of around $2,000. The income bracket makes sure that a borrower has enough money to cater for his/her needs as well as the loan installments without a problem. If your income level is below or above the figure, you may liaise with your lender to organize some better terms for you. You might be required to provide your employer’s telephone number or a bank statement from your account to prove your level of income. However, most lenders are flexible and will come up with a personal solution for your loan’s need.

US Resident

You must be a resident of the United States to get instant cash loans from the 3 year loans. You must therefore provide valid ID card details, National Social Security number and telephone. The website will not be in a position to advance loan to you if you come from other countries. Also, some states may be restricted depending on the lender’s terms. However, since the entire loan application is automated, you will only get the best quotes from lenders that accept residents from your state. For some lenders, the following states may not be allowed to apply for the three year loans: Arkansas, Connecticut, Georgia, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, North Carolina, Pennsylvania, Vermont and West Virginia.

Current Employment 3+ months

3 year loan lenders advance cash to people who have stayed in the employment from more than 3 months. Also, if you have a personal business, it must be in operation for at least 3 months. Job permanency is very important as far as long-term loans are concerned. Staying in a company for 3 years is a good indication that you are there to stay. It also shows that you are loyal and satisfied with the job and this ensures that you have a steady supply of income. In this regards, your monthly income will help you to repay the loan installments without any hitches or glitches. A better pay or monthly income will also help you to secure a larger loan.

Current Residence 3 + months

Majority of 3 year loans in United States prefer permanent residents who have stayed in the same area for more than 3 months. So, you must prove that you have stayed in the same region for more than 3 months before getting the loan advance. However, you may move to another resident while still paying the loan but you will need to communicate to your lender to update your address details. A permanent residence helps lenders to track you in case you are unable to pay the loan in order to agree the way forward. Some may even propose a loan top-up in order to help you to continue with your life without worrying about your financial problem.

3 year loan interest rate

While writing this 3 year loans review, I realized that the loans have better and affordable interest rates. You need to confirm with the lender about the total cost of your loan in the entire 3 years period. You will receive the APR rate alongside each lender after submitting your details for approval. However, most lenders have best rates which go as low as 4.99% per year. You must borrow and use the money responsibly to finance long term investments. You should also remember that late or missed payments come with fines and penalties and while still increasing the total fees of the loans

It is advisable to request a loan payment schedule after the loan is disbursed in your account in order for you to understand the 3 year loan rates and how the repayment schedule is spread. Remember to match the periodicity of the loan with your income. For instance, you may organize to repay the loan weekly if you are paid after 1 week. You can also ask the lender to deduct your monthly pay to recover their monthly installments.

3 year loans is the place to go when looking for flexible repayment periods and affordable interest rates. It matches you with the largest database of lenders with the most adequate conditions that fit your financial situation. Of course, the 3 year loans company is not a lender itself, but it works with the lenders that are prompt to offer the better repayment conditions.

Also, credit counseling is very important when it comes to borrowing long-term loans especially if you are facing a financial difficulty. A credit counselor can also point the best loan that will work for you and majority of them will teach how to save and spend money wisely. However, most of the work is done by the website’s program because the algorithms are able to match the best loan for you depending on your profile. You may also read other 3 year loans reviews to see how customers use their borrowed money to make their ends meet.

3 year loans Pros

5 Minute Application & Quick Funding

The first advantage of 3 year loans is the easy application procedure. Days are gone when people needed to visit a bank to access a loan. Today, you just need a computer connected to the internet to get instant cash whenever you need it. It does not matter whether you are at home, travelling or in office but you can secure the loan wherever you are. Furthermore, the website works on all browsers, so you may access it via your Smartphone’s, tablet’s or laptop’s browser. Just make sure that you have a working data plan and a valid email where the quote will be sent after the pre-approval.

Flexible Repayment Options

A 3 year loan is very flexible because the total loan amount is spread across a long period. For instance, if you borrow a loan with a total payment amount of $8,000, you will only pay a monthly installment of less than $222 per month. This is very manageable for most Americans because majority of them can not save huge sums of money to cater for their long term needs. However, most of them can commit to pay monthly installments to go towards the loan after financial something they have been waiting to buy for a long time.

Unsecured personal loans up to $10,000

Unsecured personal loans up to $10,000

Majority of 3 year loans reviews and testimonial writer like the high amount the loans advance to borrowers. There are borrowers who get as high as $10000 in a single application. The loan’s application procedure is very straightforward because no security is required. You don’t have to ask your friends to guarantee you neither do you require collateral. All you need is a reliable monthly income to qualify for the loan. Unsecured personal loans have played a major role in restoring the state of many Americans who are still struggling with personal debts and financial problems.

A good way to buy expensive items

I have realized that a 3 year loan is a great relieve for customers when writing this 3 year loans review. For instance many people have a hard time if they want to buy a vehicle, repair a house or even finance something that will benefit them for a long time. Some items are very expensive because majority of people don’t have a disposable income which they can save each month. Long term loans take the pain out of such people and present a better way for them to finance their dreams without straining. It is believed that long-term loans are able to turn poor people to rich people because they help even the poor to invest in costly projects that have higher returns.

Lower interest rates

Majority of financial institutions have a tendency of fixing lower interest rates on long-term loans because they have low risk. This is due to the fact that the monthly installments are very minimal compared to payday loans, three months, six months and one year loans. Hence, 3 year loans give customers a good chance to enjoy lower rates without any security and hence the high number of positive 3 year loans reviews. Sometimes, the item a customer buys becomes the collateral of the loan. In case of a problem, such items may be recovered by the lender. This is the same case with mortgages. Many people may lack the funds to buy a house in cash basis but with a mortgage, the entire process is smooth and cheaper.

Best way to minimize awkward borrowing

Financial problems are inevitable in life. However, this does not mean bothering all your friends, co-workers and relatives to give you money to move on with your life. If you are in business, asking partner to finance your ideas may not be a solution. Remember, the aim is to maximize profit and minimize the cost. So, long-term loans give you a better opportunity to finance your needs without awkward borrowings from friends and partners. In this way, starting a profitable company is a simple undertaking because you have the full capital at your disposal.

Financial problems are inevitable in life. However, this does not mean bothering all your friends, co-workers and relatives to give you money to move on with your life. If you are in business, asking partner to finance your ideas may not be a solution. Remember, the aim is to maximize profit and minimize the cost. So, long-term loans give you a better opportunity to finance your needs without awkward borrowings from friends and partners. In this way, starting a profitable company is a simple undertaking because you have the full capital at your disposal.

Best way to build credit

You can not build credit if you are not borrowing money. In most online 3 year loans reviews majority of borrowers say that they qualified for a small loan amount because they did not have a credit history. Lack of credit history is very different from low credit. The former indicates that the person has never borrowed a loan while the latter is an indication of a borrower who never pays loan installments on time. The best way to build a credit is to take long-term loans and as the financial institution reports on your repayment you will build a better score. This helps you to secure more long-term and affordable loans in the future from different lenders.

3 year loans Advices

The company advises the applicants to borrow money responsibly. It is important that clients review the policies of each lender. Because the company is not a lender itself, 3 year loans interest rate is not a fixed or a definite value set by the company. This factor is to take in consideration when applying with its services. Considering the high value of the APR when it is calculated for short term loans, it is recommended to not be discouraged by these values; you should know that they are calculated on annual basis.

3 year loans Cons

I have not found any disadvantage of 3yearloans.com website when writing this 3 year loans review. Majority of 3 year loans reviews are written by people who have used the services of the website and they seem to give it a 5 out of 5 star rating. Loans should be used wisely and if you want to get out of the financial problems, you must borrow wisely. This is why the website brings only the best lenders on their network to avoid you from incurring hefty charges associated with loan firms that are not approved by the government.

I have not found any disadvantage of 3yearloans.com website when writing this 3 year loans review. Majority of 3 year loans reviews are written by people who have used the services of the website and they seem to give it a 5 out of 5 star rating. Loans should be used wisely and if you want to get out of the financial problems, you must borrow wisely. This is why the website brings only the best lenders on their network to avoid you from incurring hefty charges associated with loan firms that are not approved by the government.

The website works well and generates instant and accurate long-term loans quotes if used correctly. Its developers have decades of experience in the lending industry. Each day, the innovators are adding new features and new long-term loan lenders on their network. Also, the website is a great resource for those who want to know how to borrow money and use it wisely for the intended purpose. The three year loans have helped many people to fight poverty and get on top of their bills even after facing a financial problem in their lives.

Conclusion

we hope this 3 year loans review was helpful and answered all of your questions. Three year loan advances are quickly replacing the traditional way of lending and borrowing money. Many people are busy and they don’t have the time to visit a bank to borrow money. Furthermore, no one can accept the red-tape associated with banks today bearing the current state of technology. With the affordable 3 year loan rates that are approved instantly, Americans can have a sigh of relieve because they can get cash advances right at the comfort of their living rooms. There are lots of positive 3 year loans reviews on the internet today and this is an indication that 3yearloans.com is there to help. It is a go-to platform for those who want cash sent straight to their bank account within a few minutes. If you are looking for a long term loan Try it today.

we hope this 3 year loans review was helpful and answered all of your questions. Three year loan advances are quickly replacing the traditional way of lending and borrowing money. Many people are busy and they don’t have the time to visit a bank to borrow money. Furthermore, no one can accept the red-tape associated with banks today bearing the current state of technology. With the affordable 3 year loan rates that are approved instantly, Americans can have a sigh of relieve because they can get cash advances right at the comfort of their living rooms. There are lots of positive 3 year loans reviews on the internet today and this is an indication that 3yearloans.com is there to help. It is a go-to platform for those who want cash sent straight to their bank account within a few minutes. If you are looking for a long term loan Try it today.

Click here to apply for 3 year loans