Black Diamond Visa Review – UK Secured Credit Cards For Bad Credit

Quick Review

Description: Finance, Payday Loans

What We Liked:

Helps to improve your credit scoreWhat We Disliked:

Costly, Only in the UKBased on many Black Diamond Visa reviews applying for a secured credit card is a positive step in the right direction to restore your credit health. With a lot of choices given by different banks and financial institutions learn how to shop wise read the fine print and use the cards responsibly. Time passes by quickly, before you know it your credit scores have dramatically increase just by simply taking a tighter rein in your spending habits. For those who are in doubt whether Black Diamond Visa exists there is no doubt that it does.

Remember that rebuilding good record does not happen dramatically. It takes a couple of months and years to build a solid history. Something to look forward to is when you will be able to jump from secured to unsecured credit card. Until then do your best to spend wisely within the limits set by the amount that you have deposited in your account. This only shows that there is always hope even for those who have fallen under the cracks of poor credit.

Black Diamond Visa Review – UK Secured Credit Cards For Bad Credit

f bad credit is making hard for people like you to access new credit card this vicious cycle will not end. The first step to rebuilding bad history is to apply for a secured credit card. If you are applying for a Black Diamond Visa card you are required to have a security deposit that acts as cash collateral in case in the future you begin the cycle again and default on your payment.

Think of your Black Diamond Visa card this way, your personalized training card. This card gives you the opportunity to build a new history of on-time payment. The small credit limit and security deposit will ensure that you will not fall behind and thus repeat the same cycle of your poor payment history. If you can recall you are having a hard time securing a credit card because of your bad history. In essence, you will only spend up to a certain limit that which the security deposit only covers; no more, no less. If you decide to default on payment pretty soon the 3% monthly interest rates will pile up and will become a very huge amount to pay off.

Most secured cards increase their credit limit after 6 to 12 months of responsible usage and on-time payments. Most of the time when you fail to pay on time the bank will dip into your security deposit. The good side to this scenario is that with such a small credit limit you will not get yourself indebted to a large amount. This card was dubbed as a second chance card and is a fitting description of how creditors are given their second chance at applying for credit.

How Does it Works?

How Does Black Diamond Visa Work?

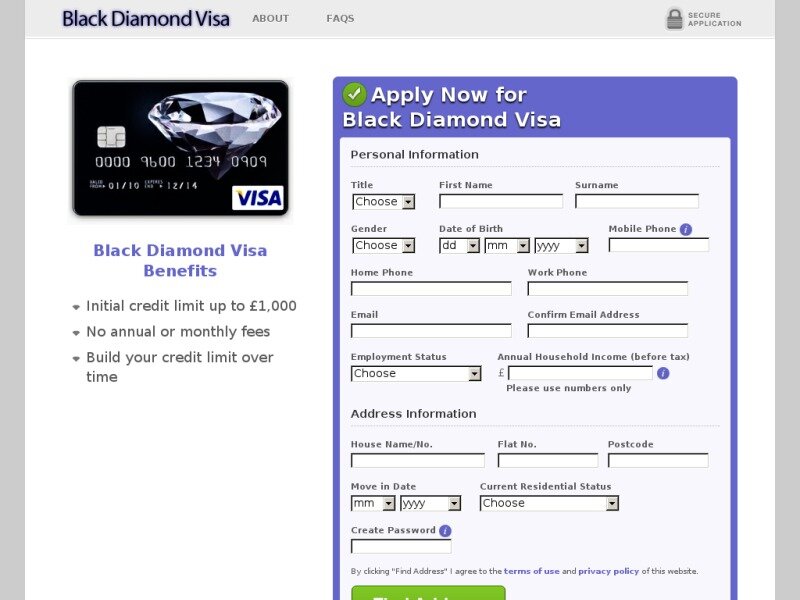

You must first agree to use the credit card for at least 12 months. A year is enough to start rebuilding a good credit. You must agree to pay the monthly fixed fee before using the credit card. You will be required to sign a loan agreement which states that you are only allowed to borrow depends on the amount that is in your card. However, expect to pay for additional fees which are included in the loan terms stipulated within your agreement.

You must first agree to use the credit card for at least 12 months. A year is enough to start rebuilding a good credit. You must agree to pay the monthly fixed fee before using the credit card. You will be required to sign a loan agreement which states that you are only allowed to borrow depends on the amount that is in your card. However, expect to pay for additional fees which are included in the loan terms stipulated within your agreement.

It is one thing to be allowed to have a secured credit card and not reading the fine print that goes with it. Do not act surprised if in case you just sign the agreement without bothering to read it entirely. You are required to pay a certain amount of money each month as part of the loan repayment plus of course the interest charge. Ensure that you have an extra amount to cover what you owe, covering also the other fees and interest rates involved.

Try to plan how you will spend your money from now on. Are you planning to spend this online or for a specific need? If you are behaving responsibly, this provider will report successful repayment of your loans to a credit reference agency. Ask your bank how they will do this so that you can ask for a copy from your credit agency to see the remarkable change in your credit history.

Increase Your Credit Rating

Why Is Increasing Your Credit Rating Important?

Viewing your credit rating will help future lenders decide whether to lend you money and bigger loans. This will also help them gauge how much interest rate they can charge you with. Those with bad credits are constantly reminded to avoid any negative impact on the damage credit ratings in the first place.

Banks will not easily loan you a huge amount because they are afraid that your finances are overstretched. Their first major concern is that they will not easily get back the money that you loan. Credit records will usually reflect the missing or late payments that you have made in the credit file for at least 6 years.

Avoid applying for credit loans at the same time. This is usually reflected on your credit records. If you are just planning to shop around for the best deals and interest rates better check it out directly with the lender first. They can offer a quotation that will give you a good idea of how much they will charge you in case you file for this and that loan. This quotation will in no way affect your credit scores.

Avoid opening too many credit card accounts since this will be viewed negatively as well. Lenders usually do a background check on you. Better have registered with the electoral registry. This will verify your identity and the address that you are using. Lenders will not find it comforting to see that you move a lot. This might be misconstrued as an evasive tactic on your part to avoid paying what you owe.

Black Diamond Visa Review

Pros

The terms given are clear it depends on the credit card holder, whether he disregards the reminders attached to this secure credit card. Black Diamond Visa starts with a reasonable credit line of £150 to £1000. This is more than enough to cover most daily needs. After your fourth bank statement the bank has observed how you behave responsibly, they can increase this amount up to £3000

The terms given are clear it depends on the credit card holder, whether he disregards the reminders attached to this secure credit card. Black Diamond Visa starts with a reasonable credit line of £150 to £1000. This is more than enough to cover most daily needs. After your fourth bank statement the bank has observed how you behave responsibly, they can increase this amount up to £3000

Black Diamond Visa review state that this secured card has been recognized as one of the best introductory credit cards in the market today. This is a better alternative instead of applying for mortgage loans that will lull you into a sense of complacency. This secured credit card is dubbed as prepaid bank card or a credit builder because you can only withdraw what you have put in except of course for some extra fees that the banks charge you with.In case you change your mind, you can always cancel the card and have your money returned less the amount that you have on loan plus the fees involved.

Cons

Black Diamond Visa charges steep monthly interest rates. If computed within 12 months it will amount to about 59.9% such a steep amount to pay indeed. It all boils down to the truth that not all banks will allow individuals who have bad credit to get approved credit card.

The bank does not offer a grace period. You are required to pay the interest rates. In a way this card is teaching you to become more responsible so as to avoid falling in the dire circumstances that you were in a few months before you applied for this card.

In addition to this the bank will charge another fee which adds to the total amount that you are required to pay. Most of the time you will also be charged inactivity fee if in case you are not using your card.

Black Diamond Visa is offered only in the United Kingdom.

Conclusion

Based on many Black Diamond Visa reviews applying for a secured credit card is a positive step in the right direction to restore your credit health. With a lot of choices given by different banks and financial institutions learn how to shop wise read the fine print and use the cards responsibly. Time passes by quickly, before you know it your credit scores have dramatically increase just by simply taking a tighter rein in your spending habits. For those who are in doubt whether Black Diamond Visa exists there is no doubt that it does.

Based on many Black Diamond Visa reviews applying for a secured credit card is a positive step in the right direction to restore your credit health. With a lot of choices given by different banks and financial institutions learn how to shop wise read the fine print and use the cards responsibly. Time passes by quickly, before you know it your credit scores have dramatically increase just by simply taking a tighter rein in your spending habits. For those who are in doubt whether Black Diamond Visa exists there is no doubt that it does.

Remember that rebuilding good record does not happen dramatically. It takes a couple of months and years to build a solid history. Something to look forward to is when you will be able to jump from secured to unsecured credit card. Until then do your best to spend wisely within the limits set by the amount that you have deposited in your account. This only shows that there is always hope even for those who have fallen under the cracks of poor credit.

Click here to get Black Diamond Visa